By Diana Hovakimyan

On May 7th, 2014, the USAID-funded Tax Reform Project (TRP) team held a public presentation on Armenian Tax Perception Survey 2013, which was designed and conducted by Caucasus Research Resource Center (CRRC)-Armenia in November-December 2013. More than 1,440 households and 400 business entities and individual entrepreneurs, selected through multi-stage clusterized sampling, were interviewed in all regions of the Republic of Armenia via face-to-face interviews with standardized questionnaire.

On May 7th, 2014, the USAID-funded Tax Reform Project (TRP) team held a public presentation on Armenian Tax Perception Survey 2013, which was designed and conducted by Caucasus Research Resource Center (CRRC)-Armenia in November-December 2013. More than 1,440 households and 400 business entities and individual entrepreneurs, selected through multi-stage clusterized sampling, were interviewed in all regions of the Republic of Armenia via face-to-face interviews with standardized questionnaire.

The main goals of

survey were to identify

attitudes of general public and business community toward the tax authorities,

facilitate an improved public-private discourse, help develop effective and

efficient tax policies and tax administration, and raise awareness of tax

policy and tax administration related issues in the Republic of Armenia. Public

presentation of the CRRC-Armenia implemented survey results was an opportunity for the Government of Armenia,

private sector organizations, advocacy groups, business associations, as well

as tax professionals and other interested stakeholders to get information on

public perceptions about tax related issues, and discuss the main findings of

the survey.

In his opening

remarks Mr. Janusz Szyrmer, Chief of Party of the USAID Tax Reform Project, emphasized

the significance of such initiative. Mr. Gagik Khachatryan, Minister of Finance

of the Republic of Armenia, mentioned that the survey results could serve as an

important guide in developing the tax code. Director of USAID/Armenia Karen

Hilliard noted that there was a need to conduct the survey annually in order to

benchmark the progress of the Armenian tax system over time. According to Dr.

Hilliard, the implemented survey will play a key role in promoting dialogue

between the state and private sector. In addition, Mr. Jean-Michel Happi, the

World Bank Country Manager for Armenia recognized the importance of the survey

in improving the tax system in Armenia.

Afterwards, CRRC-Armenia Program

Coordinator Lusine Zakaryan presented the main findings of the survey. According

to the findings, 67% of household respondents receive information about taxes

from the TV and radio, whereas 48% of businesses receive the same information

from tax bodies.

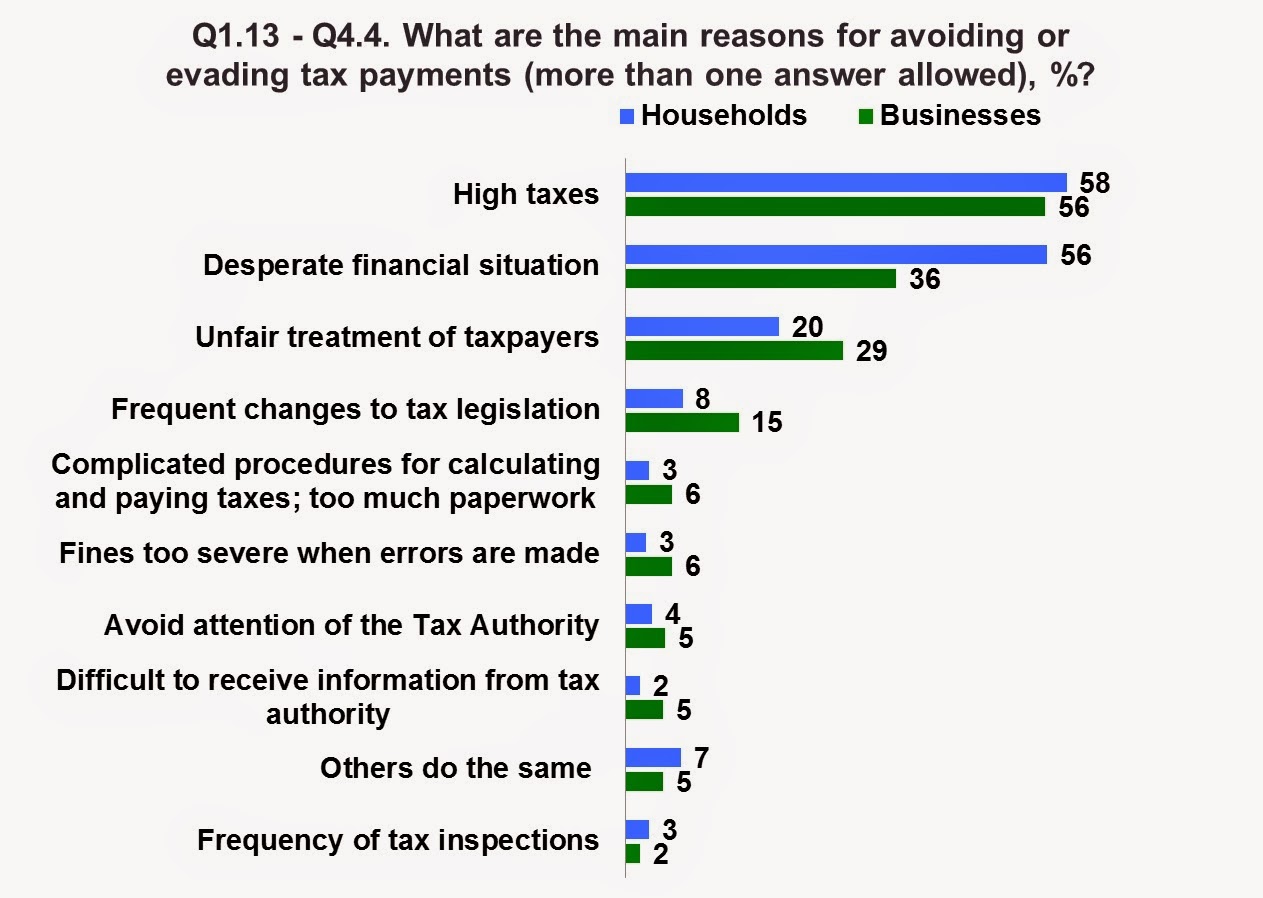

Other findings indicated that one of the main reasons for avoiding or evading tax payments for the majority of households (58%) and businesses (56%) were high tax rates.

At the end, Mr. Armen

Alaverdyan, Deputy Head of the State Revenue Committee mentioned that there was

a need to make a comparative study with other transition countries to have more

complex and consolidated approach in the long run.

Other information on TRP can be accessed through

CRRC-Armenia website.

Comments